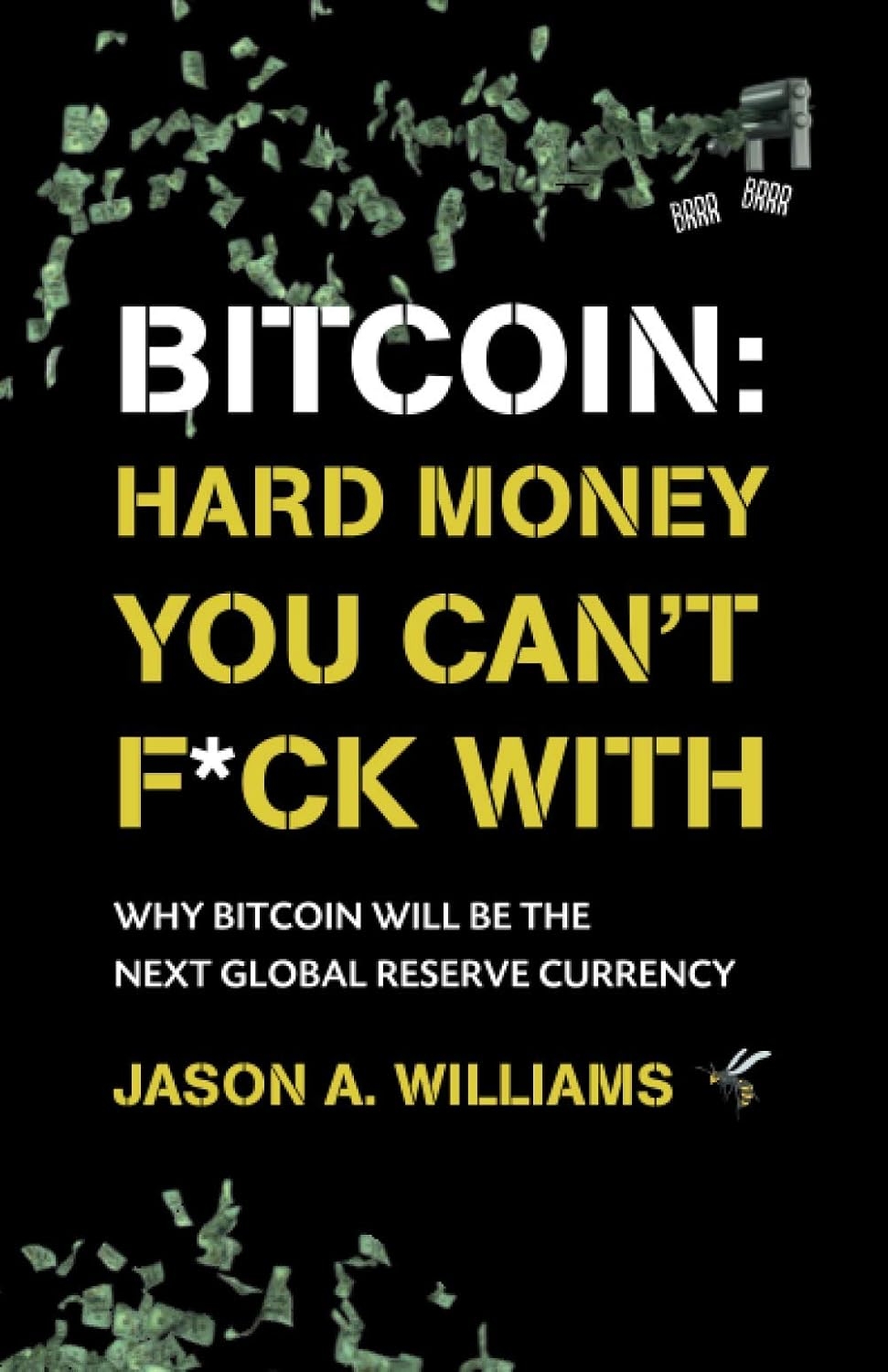

Bitcoin: Hard Money You Can’t F*ck With: Why bitcoin will be the next global reserve currency

£28.65

Additional information

| Dimensions | 13.97 × 1.32 × 21.59 cm |

|---|---|

| Publisher | Going Parabolic (8 Dec. 2020) |

| Language | English |

| Paperback | 218 pages |

| ISBN-10 | 1838318402 |

| ISBN-13 | 978-1838318406 |

| Dimensions | 13.97 x 1.32 x 21.59 cm |

10 reviews for Bitcoin: Hard Money You Can’t F*ck With: Why bitcoin will be the next global reserve currency

You must be logged in to post a review.

Robert Parr –

I read this book when it first came out and I may have read it four or five times since then. The author deals with why Bitcoin is important, in straight forward language which is not full of technical jargon. It’s a great book.In 1971 American President Richard Nixon took the dollar off the gold standard, where every dollar was backed by an equivalent amount of gold, and introduced the equivalent of economic heroin into the American economy, THE PRINTING OF MONEY. Money printing is only possible with Fiat money, that is paper money not backed by anything other than belief that it is worth something. Since then politicians and central bankers all over the world have used the printing of money to pay for wars, or anything else that took their fancy. Once started they find it impossible to stop, it’s just too easy to print money.As money is printed its value is diluted hence prices go up. Printing money which is now called – Quantitative Easing, destroys savings and confidence in currencies , and as the dollar is the de facto world currency, money printing is a major global problem. As a by-product of this the rich get richer and everybody else gets poorer. This has happened for centuries with currencies where the total supply is not fixed and can be increased by, you guested it – politicians and central bankers. See Saifedean Ammous – The Fiat standard and The Bitcoin standard. Professor Ammous elegantly explains the theory and history of money and how money printing destroys respective currencies.This could not happen to major world currencies in 2024, surely not? Well imagine you could buy a precious object for $50,000, and two years later you could buy a loaf for $50,000. Sounds crazy doesn’t it, but the equivalent of this happened in Germany in the early 1920s. See “When Money Dies” by Adam Fergussan. It was just politicians and central bankers printing money.In 1999 the American economist Milton Freeman predicted electronic money on the internet, free of interference from politicians and central bankers. Around the same time the UK politician William Rees-Mogg wrote “The Sovereign Individual” in which he talks of cyber money, again free from politicians and central bankers. Both foresaw the problems associated with fiat money, not backed by anything other than belief and subject to political interference.So why all the fuss about Bitcoin. Well Bitcoin is scarce with a maximum supply of 21 million, 90% of which have already been created and are already in circulation. Bitcoin has all the properties of good money and, guess what, it’s free from interference from governments and central bankers.So lets get back to “Bitcoin: Hard Money you can’t F with”. This is a brilliant book, written in everyday pithy language, with a good sprinkling of Anglo Saxon to boot, which I am sure Amazon would not wish to print. Everybody should read this book. Amazingly the book is already out of date in two respects.Near the end of the book the Author, who comes over as a great guy you would just want to go for a beer with, says “One day there will be Exchange Traded Funds ( ETFs ) in Bitcoin” which will make bitcoin easily available for everybody to get involved with. In January 2024 the US Securities and Exchange Commission ( the SEC ) approved eleven exchange traded funds for major American organisations like Fidelity, Black Rock, Arc Investments etc, and the demand for bitcoin has gone off the wall.Secondly he said that American debt was 27 Trillion dollars. That is 27 Million Million dollars.Way off beam in just a few years. As I write this review American debt is somewhere over 34 Trillion dollars and growing at a rate of about one Trillion dollars every three months.The debt is presently above $102,000 per person in the country including new born babies.Do you think modern day politicians will be able to fix this problem? I wouldn’t bet on it. Just Google “The American Debt Clock” and have a look. If you are not convinced the world needs an alternative to Fiat money try “97% Owned” on Netflix and have a look at the UK economy. Debt, over £47,000 per person, or you could just Google “Debt Clocks”. Most of Europe is in debt, and the list goes on.One thing I think is important. The world is full of people who can tell you that Bitcoin is a scam, a con, a fraud, neigh even a Ponzi Scheme. I was told that in 2018. Most of this advice is based on opinion which is mostly based upon thin air. Research and look into Bitcoin yourself. Hard Money – explains clearly what it is, why it is needed, and why it will not go away. Today Bitcoin is about $60,000 / coin. Near the end of the book the author says, in the future people may say something like – “You’ve got one Bitcoin. Man how cool is that.” And he’s not talking about $60,000 / coin.Thinking about world debt, it is impossible for individuals to create trillions of debt. It all comes back to the usual suspects.Hope you enjoy the book as much as I did.

Jake curtis –

I really struggle to get into a book but this grabbed me, so much so that 4 chapters in I insisted those in my circle began reading it as a matter of urgency. Jason isn’t your typical author, he has a way with words that make him alot more relatable and interesting. His no BS approach and knowledge to the subject matter is of an elite standard and you should certainly look deeper into him and associate Pomp. I’ll continue to follow him through this world and bug him on twitterAs a millennial I grew up a digital native, the need for instantaneous information is all too present in my life hence why I struggle to dedicate myself to a book.These effects will be more prevalent in those younger than me, a point made in the book is that the current systems inhabitants will soon grow old and my generation will succeed them…a digitally native generationwho will “choose the digitally native cryptocurrency. The one born naturally on the internet with an immaculate conception, not twisted and warped from a broken fiat system. They’ll choose the one backed by the strongest computer network on the planet, with no central authority.”The future is Bitcoin, do yourself and your kids’ kids a favour, read this book.A global generation bound by no borders, powered by the internet will demand a truly global currency.”These ‘young, inexperienced kids’ are exactly the ones who will turn bitcoin into the worlds next reserve currency. There’s a generational tide turning that will change everything…There’s a generation shift in investor mindset happening. Over the next 25 years, $68 trillion of wealth is going to be handed down from boomers…it’s not going to stay in gold. Alot of it will go into Bitcoin.””Younger people are growing into positions of power and they’ll streamline the new digital era. The demographics are moving in bitcoin’s favour.”A smart investor is future and innovation orientated, forget the shiny rocks….stack SATs & Chill.Bitcoin will enable me to purchase my first home at the age of 25, something far more doable in yester-year. I choose to opt out of a failing system, Bitcoin does this for me and I’m still EARLY.

SIN89 –

A really fasciniting insight about Bitcoin, history of money, economic events, debt, inflation, and interest rates. Really enjoyed reading this book. Absolutely flew through it. Highly recommend this book for anyone who wants to understand more around the cryptocurrency space and how bitcoin provides a solutions to our flawed economic / monetry system.

Fan of BTC –

Enjoyed reading this book – perfect for someone looking at this industry for the first time but also very enjoyable for people like me that are quite well read in the world of bitcoin and crypto.

philip mcleod –

I loved how clear and down to earth the language was. This read like a story rather than a non-fiction book. It’s also addressing very interesting and pertinent topics that everyone in the world should review more deeply and so I’m recommending this book to all my friends and family.

Eric Smith –

This book will greatly increase your understanding of Bitcoin and bitcoin (Aha!). Answers many questions for the cryptocurrency novice like myself. Engagingly and entertainingly written, easy to follow.

omar –

Bought this book in order to learn more about what bitcoin is and it’s future potential. Well worth the money!

coz –

Forget the BTC part, i learnt alot about money and how the economy works. Essential reading. Bought a hard copy just to have

Ed Cleaves –

High Level Reinforcement of Why Bitcoin Is Important

I appreciated the broad coverage of many relevant topics, including a succinct summary of global monetary history, the rising influence of China in geopolitical issues, the global escalating debt levels since 2020, the weaponisation of the US dollar since Russia’s invasion of the Ukraine and the potential lifeboat alternative that Bitcoin offers. All in all; a nice and easy to read addition to my library of books about bitcoin and the global financial system.

Carlos Suarez –

Master piece, now I’m a maximalist of Bitcoin.

An awesome and powerful bookGreat notes and quotesSuch a great information.